Foreign Tax Credit – Optimizing on a US Tax Return

US citizens and permanent residents are taxed on worldwide income, regardless of where they live in the world. Fortunately, there are two common methods that US expats utilize to eliminate or lower US taxes on income earned abroad. The first is the foreign earned income exclusion, which allows one to exclude up to roughly $100K in foreign income. The second method is the foreign tax credit (FTC), which is the main topic of this article. Frequently, US expats and dual citizens erroneously use the foreign earned income exclusion, when they should be utilizing the foreign tax credit. Before we jump into the nuts and bolts of the FTC, it’s worth stating that the application of the foreign tax credit is somewhat complicated. However, a thorough understanding of the FTC may have a BIG $$$ impact on your finances. With that introduction, let’s dive into the topic of optimizing the foreign tax credit on a US tax return.

Foreign Tax Credit – Optimizing on a US Tax Return

The FTC exists to provide relief from double-taxation. Income taxes paid to a foreign country can be used to offset US taxes. In our opinion, there are 3 important factors to consider when deciding between the foreign tax credit and foreign earned income exclusion.

- Effective tax rate in the foreign country vs. the rate that would apply in the US

- Whether there is income in both a foreign country and the US

- Whether there are children in the household

Effective tax rate in the foreign country vs. the rate that would apply in the US

Generally speaking, if you are paying a higher tax rate in the foreign country than you would under the US system, it’s better to utilize the foreign tax credit (on Form 1116). Foreign taxes paid often eliminate any US tax liability. The difference between foreign taxes paid and the US tax amount results in foreign tax credit amounts that are carried forward (i.e. can be used in subsequent years).

Alternatively, if you are paying a lower tax rate in the foreign country than you would under the US system, then the foreign earned income exclusion should be exercised (on Form 2555). If one has income above the $100K limit, then both the foreign earned income exclusion and foreign tax credit should be utilized. A pro-rated amount foreign taxes paid can be applied on the income above the exclusion limit.

Whether there is income in both a foreign country and the US

When a US person has income in both a foreign country and the US, the decision to utilize the foreign tax credit should be based on the proportion of foreign income to US income. That is because the maximum foreign tax credit one can utilize is limited by the % of foreign income to total income. For example, if a person has only foreign income, then he or she can apply 100% of foreign taxes paid toward the US tax liability. However, if the split of foreign to US income is 50/50, then the maximum foreign tax credit one can utilize is limited to 50% of the US tax liability. Bottom line: utilizing the foreign tax credit is advantageous when most of one’s income is derived from foreign sources.

Whether there are children in the household

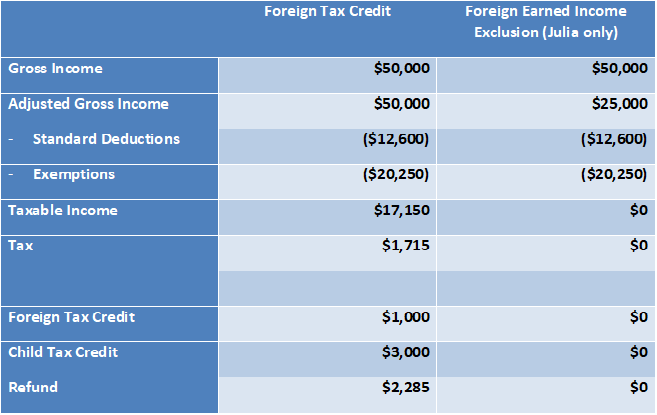

When there are children (under the age of 17) in the household, many US expats are able to claim the child tax credit, worth up to $1000 per child. Unfortunately, this credit can no longer be used to claim a refund when the foreign earned income exclusion is utilized on a tax return. However, the child tax credit is still applicable when utilizing the foreign tax credit. Therefore, there can be situations where utilizing foreign tax credits may create taxable income (vs. the foreign earned income exclusion); however, the applicability of the child tax credit will more than offset the taxable income, result in a refund. The following is an illustration of the rough math involved.

Julia and John each earn $25K in foreign wages. They are both US citizens, and have 3 children under the age of 17 (all of whom have Social Security #s). From the $50K in combined wages, Julia and John paid only $1K in foreign taxes.

With the foreign tax credit approach, there is usually taxable income. In many instances, however, the calculated tax amount is more than offset by the combination of foreign taxes paid and the child tax credit. In the above example, it is clearly in Julia and John’s interest to utilize the foreign tax credit on their tax return vs. the foreign earned income exclusion. Often times, it is advisable to amend prior year tax returns to claim refunds that were missed. The aggregate refund amount can be surprisingly sizeable.

In summary, many US expats ignore the foreign tax credit, and utilize the foreign earned income exclusion because of simplicity. However, the FTC can be very advantageous depending on one’s circumstances. Don’t let a little bit of complexity undermine your finances.

For general information on US expat taxation, please read: US Taxes for Americans Living Abroad – Ultimate Guide