Tax Reform Becomes Law

The House and Senate has approved a significant overhaul of the US tax code. For US expats, the three biggest components of tax reform (a.k.a. the ‘Tax Cuts and Jobs Act’) include: (1) doubling of standard deductions, which two-thirds of American households utilize on tax returns; (2) reduction of tax rates in five of seven brackets; and (3) doubling of the child tax credit. This article analyzes these three components, as well as, summarize some of the other changes.

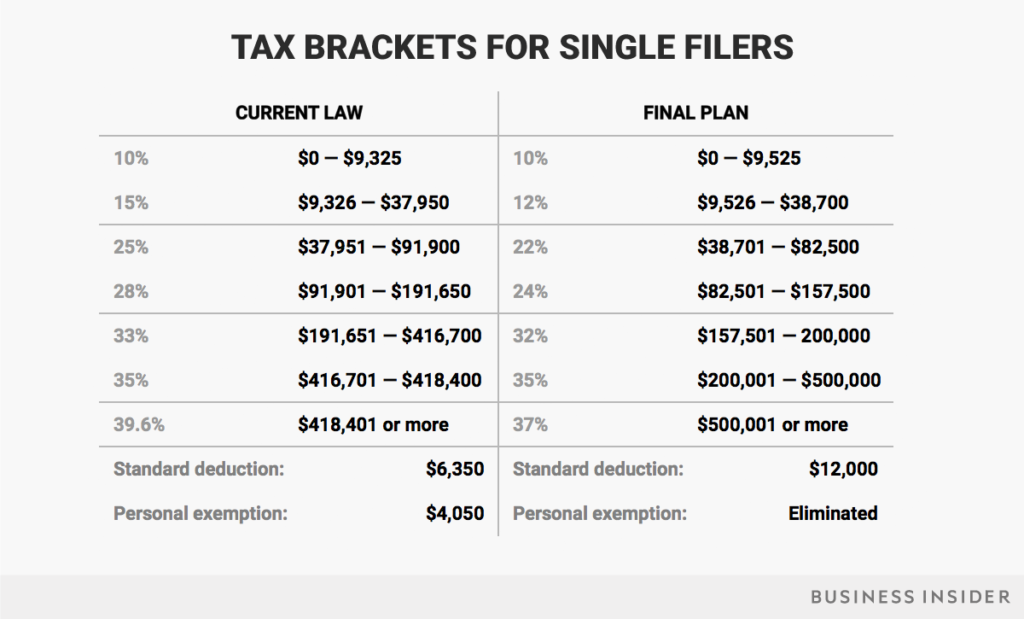

Doubling of Standard Deductions and Reduction in Tax Rates

Standard deductions will nearly double, but personal exemptions go away. For a single filer, the standard deduction increases from $6,350 to $12,000. The overall impact (accounting for personal exemptions) is $1,600, still a positive for those who use standard deductions.

With respect to tax rates, the changes favor modest and very high income earners. Those in the “upper middle class” are hurt by the new tax rates (roughly speaking, a single filer with taxable income from $200K to $400K).

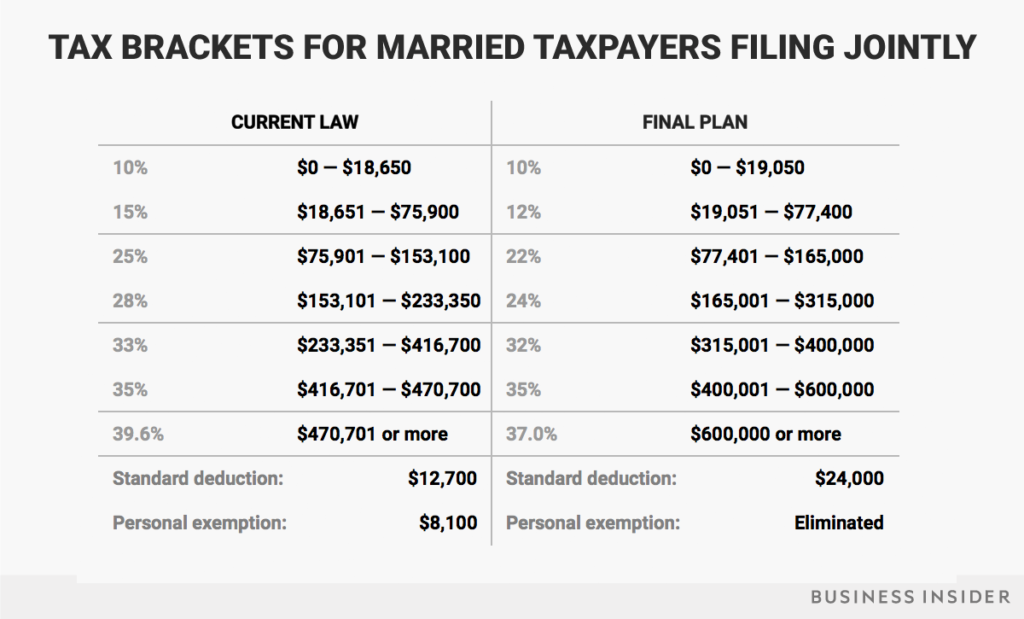

For joint filers, it’s a similar story. The overall impact of doubling standard deductions, but eliminating personal exemptions is a positive $3,200.

With respect to tax rates, the changes are favorable across all brackets. However, very high income earners receive the most benefit (roughly speaking, households with taxable income over $500K).

Families with dependents are negatively impacted by the elimination of personal exemptions. That is because the increase in standard deduction does not offset the loss of personal exemption amounts, which can be significant depending on the size of the household. However, the loss of personal exemptions needs to be considered in combination with other factors (e.g., lower tax rates, child tax credit) to assess the net impact.

Child Tax Credit – A Big Plus

The child tax credit will increase from $1,000 per child to $2,000 (refundable up to $1,400). Many US expats currently take advantage of the child tax credit, and receive refunds without ever having paid taxes (i.e., free money from the IRS). Subject to calculation, the refund maximum increases by $400 per child.

In addition, the phase-out starts at $400,000 (AGI) for married filing jointly. The current phase-out begins at $110,000, which means that higher-income earners will be able to benefit from the child tax credit.

State and Local Tax Deduction (SALT)

For taxpayers that itemize deductions, the bill caps the deduction for state and local taxes at $10,000. This is the reason that 12 Republicans in the House (mostly representing California, New York, and New Jersey) voted against the bill.

Estate Taxes

Tax reform keeps the estate tax at 40%, but doubles the exemption levels (currently $5.5M for individuals and $11M for married couples). Clearly, this is a favorable change for ultra-wealthy Americans.

Healthcare Mandate

Starting 2019, tax reform ends the individual mandate, a provision of Obamacare that triggers tax penalties for individuals who do not obtain health insurance coverage. The individual mandate has been a thorn for many modest-income families. According to the IRS, nearly 80% of households that pay the penalty make less than $50K per year. This means modest-income families were stuck paying up to $2,085 for simply not being able to afford health insurance. Fortunately, most US expats are exempt from the Obamacare penalty.

Tax Reform – Who Benefits?

- Modest-income earners

- Families with children

- Married households

- High income earners living in low tax states

For general information on US expat taxation, please read: US Taxes for Americans Living Abroad – Ultimate Guide.